When do you start to banish those post Christmas blues with thoughts of sun, sea and sangria? It’s a critical question for the travel business and for at least one company it appears the answer is 10 days before the start of Christmas.

This week's data series takes a warm dip into the ‘Share of Voice’ tool that is part of our favourite TV insight software - ActiveVoice.uk. It enables users to quickly find brands, identify their key competitors and report their ‘share of voice’. The share of voice metric is a key datapoint within TV advertising. It reports the percentage of TV impacts for each advertiser within a competitive sector. The theory is that share of voice translates into share of market and is a key driver of revenue growth for businesses. In this week's data series we analyse the share of TV impacts across a selection of the UK’s biggest travel companies.

Back in the good old days, Boxing Day TV arrived with a steady stream of ads showcasing Spanish beaches, kids careering down pool slides and romantic couples strolling around an idyllic Greek village. Christmas was well and truly done and it was time to start planning the big, once-in-a-lifetime summer holiday. Airtime costs were lower too after Xmas and harder to reach audiences were more at home and available to view.

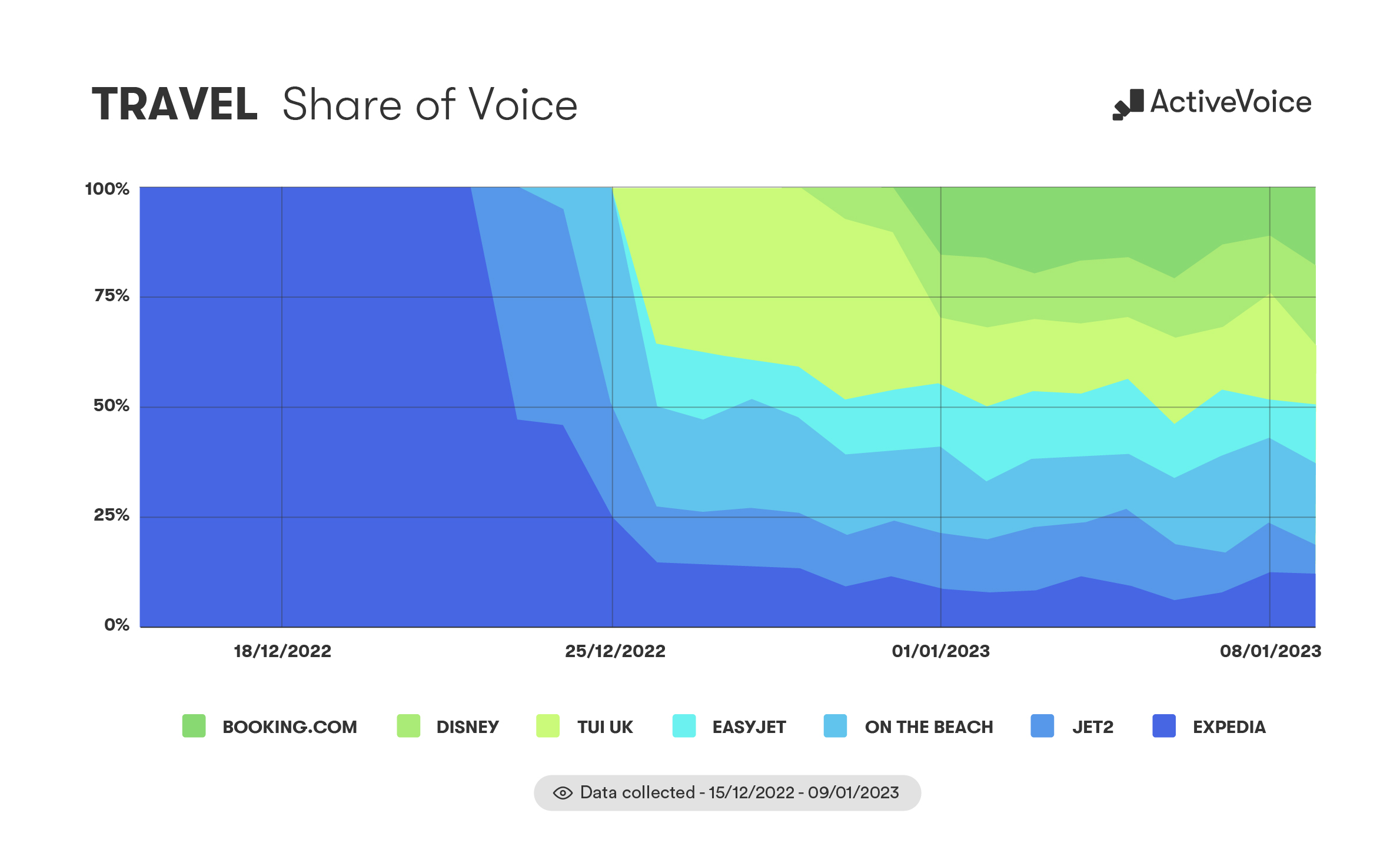

Our initial plan was simply to dig into the Boxing Day share of voice for seven of the biggest travel operators (Booking.com, Disney, EasyJet, Expedia, Jet2, OnTheBeach, TUI). But then we noticed something odd. It seems that three of the magnificent seven could be changing tactics in the post digital era.

Rather than focus on the traditional post-Christmas period, Expedia’s campaign started on15th December. It enjoyed a clear period of 8 days where it had 100% share of voice across the seven rivals. Was it to capitalise on the latter stages of the World Cup? All those shots of crowds in warm sunshine whetting the holiday booking appetite? Or, given their huge online investment, was it to bag a bit of brand building on TV ahead of the main event? It wasn’t until 23rd December that Jet2 joined the battle with OnTheBeach getting out of the starting blocks on Christmas Eve. EasyJet and TUI stuck with tradition and launched on Boxing Day, with Disney (land Paris and Florida) waiting until the 30th and booking.com launching on New Years Day. Guess their tactic was new year, new start (let’s book the holiday).

By Boxing Day Expedia’s share of voice had fallen to just 14.7%. Still, they got off to a blistering start and had a free run of holiday ads before the others got started.

See you next week. In the meantime, please feel free to suggest topics / sectors / brands for a future data series.